[Guide] Quota Rent Explained: Definition, Calculation & Who Benefits

How does a seemingly simple trade restriction like a quota impact the intricate workings of an economy? Quota rent, the economic windfall resulting from import quotas, is a subtle yet significant factor that reshapes market dynamics, influences pricing, and ultimately, affects the flow of wealth.

At its core, quota rent represents the economic rent received by the owner of an imported good that is subject to a quota. It's a form of profit, an additional revenue stream, earned by those who are granted the privilege of importing goods within the limits set by the quota. This privilege allows them to purchase goods at a lower world market price and sell them at a higher domestic price, effectively capturing the difference. The concept, while rooted in economic theory, has tangible real-world implications that businesses, governments, and consumers alike must navigate.

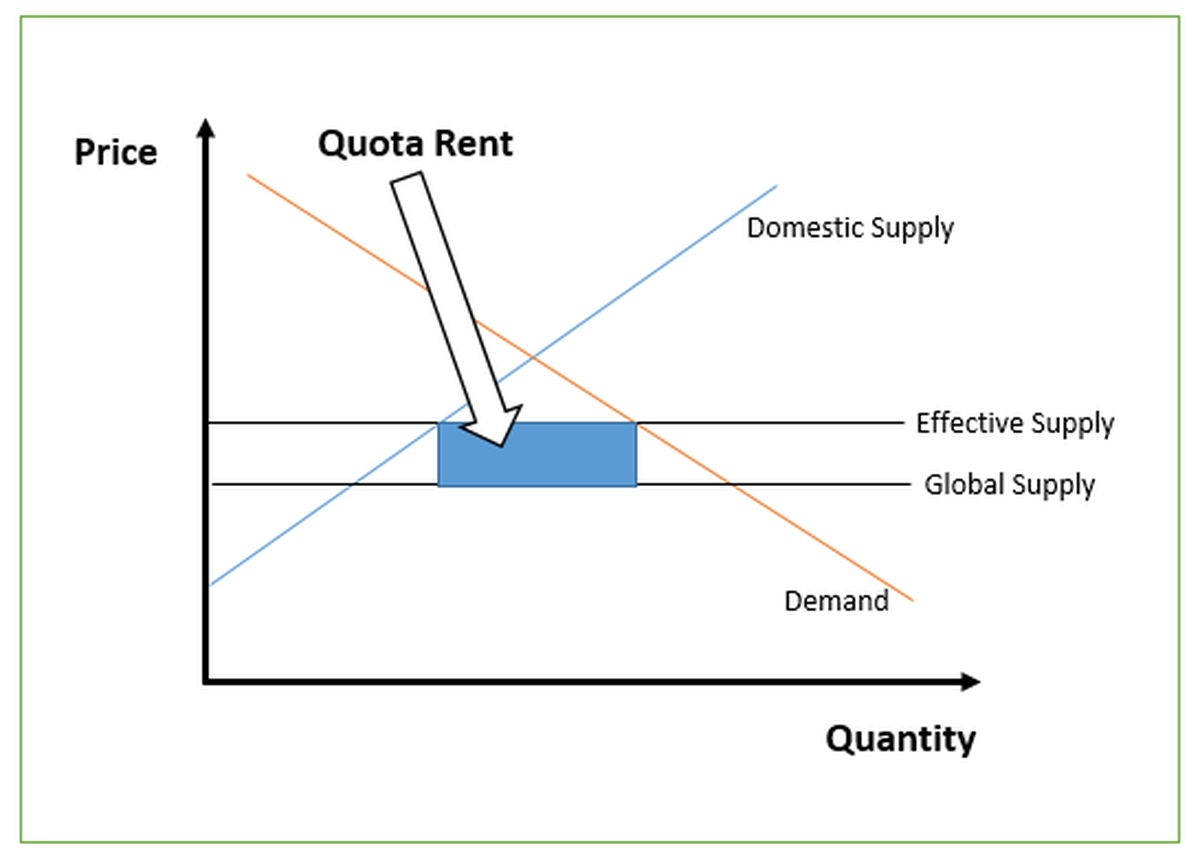

To fully understand quota rent, consider this: when a government imposes an import quota, it restricts the quantity of a specific good that can enter the country. This artificial scarcity, in turn, drives up the domestic price of that good. If the domestic price is higher than the world market price, the difference represents the potential for quota rent. The size of the rent depends on the difference between these prices and the quantity of goods imported under the quota. This "extra" profit is not earned by producing a good, but by being granted the right to import it.

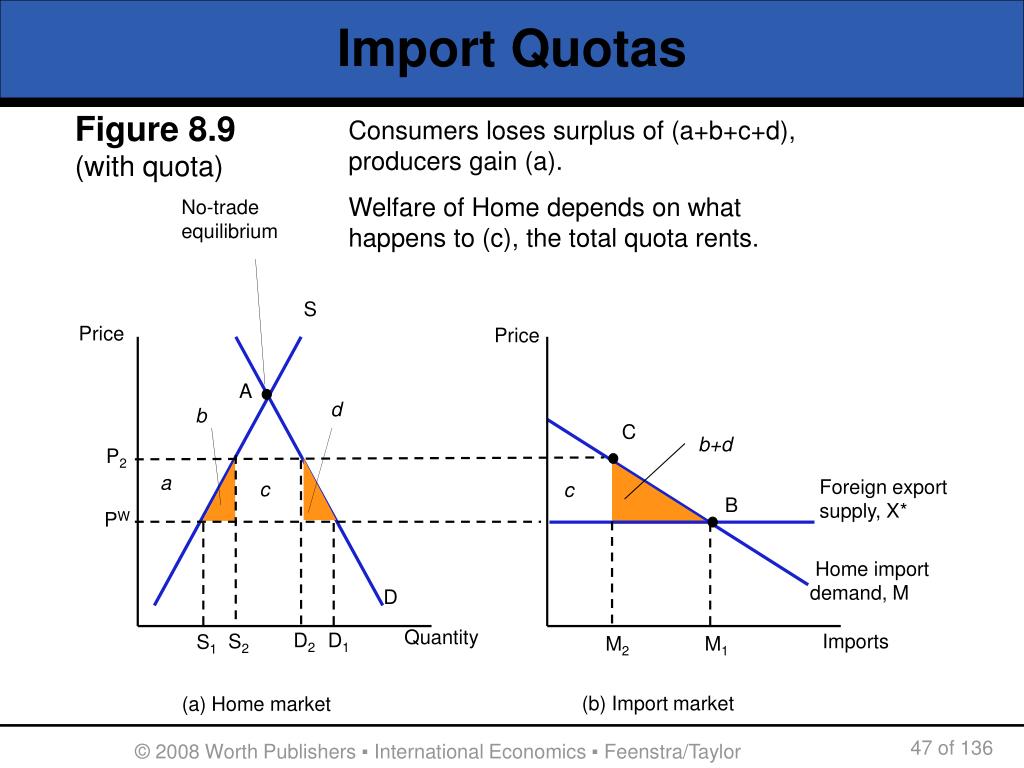

The allocation of these rents is a critical aspect of the analysis. Who ultimately benefits from this economic windfall? It varies. If the government auctions off the quota rights, the government itself reaps the rewards. This is akin to the government collecting a tariff. If the government gives the quota rights away, the beneficiaries could be domestic importers, foreign exporters, or a combination of both. The implications of each scenario can be quite different, influencing trade relationships, consumer prices, and the overall economic welfare.

The presence of quota rents has significant implications for economic efficiency. They can lead to a welfare loss for the importing country. This is because quotas distort the market, reducing the gains from trade. The aggregate welfare effect for the country is found by summing the gains and losses to consumers, producers, and the domestic recipients of the quota rents. This leads to a negative production efficiency loss, and a negative consumption efficiency loss. Consumers face higher prices and reduced choice, while the market as a whole operates less efficiently.

Economists often analyze quota rents to understand how trade policies impact market dynamics. Calculating quota rent can reveal how actions such as import restrictions and tariffs influence the prices consumers pay for products. The process involves extensive research and detecting quota rent in the cost of goods as well as any indirect or hidden quota rent. This understanding helps in assessing the true costs and benefits of trade restrictions and in designing more effective trade policies.

Consider the scenario where the government gives the quota rights away to foreign exporters. In this case, the foreigners receive the quota rents. This would imply that these rents should be shifted to the exporting countrys effects and subtracted from the importing countrys effects. In other words, the importing country effectively transfers wealth to the exporting country. This transfer can strain international relations and create political tensions.

Let's delve a bit deeper into the mechanics. The amount imported under the quota could have been imported at the world price, but these goods command a higher domestic price. This price difference is the source of the quota rent. The important question becomes, how are these quota rents allocated? The answer determines the distribution of the economic gains and losses associated with the quota.

Quota rents are, in essence, extra profits that domestic producers or foreign exporters can earn by selling a limited quantity of a good at a higher price than the world market price. This represents an inefficiency, a distortion in the market caused by the artificial restriction on supply. This inefficiency is a representation of higher aggregate pricing of goods resulting from the artificially lower supply of the imported good.

The core concept of "rent" in economics is relevant here. In economics, a "rent" is the payment to owners of a scarce asset in excess of what is required to supply the good. Quota rent fits this definition, as it represents revenue in excess of the opportunity cost. For example, consider a piano. With an import quota in place, the domestic importers who are able to import under the quota can earn quota rents. If there are no transportation costs, a quota holder can make a pure profit, called a quota rent, equal to the difference in prices. This profit arises because the quota restricts the supply, leading to higher prices than would occur in a competitive market.

The distribution of quota rents is often a subject of debate. Who gets to collect these extra profits? The answer has profound implications. If the government auctions the quota rights for their full price, then the government receives the quota rents. This is a situation where the government effectively captures the economic benefit. If the government gives away the quota rights by other means, then the recipients could be domestic firms, foreign exporters, or other specific groups. In this case, the distribution of quota rents can affect domestic industries, foreign trade, and international relations. The economic benefit can vary based on who controls those import licenses.

The government could give away the quota rights, perhaps to domestic firms, or it could allocate them based on historical import volumes. The specific mechanism determines who benefits. Depending on the mechanism, it is possible that the exporting country also benefits, which can strain international relations, depending on the scenario.

In an environment with an import quota, domestic importers who can import under the quota can earn quota rents. These rents arise because the quota limits supply, resulting in higher prices than would be seen in a competitive market. This creates an opportunity for profit, where the importers can buy at a lower world market price and sell at a higher domestic price. The amount of the rent is the difference between the world market price at which the importer bought the goods and the domestic price at which they sell the goods.

The implications of quota rents extend beyond the immediate stakeholders. They can affect consumer prices, impacting the cost of goods. The restriction on imports, by design, reduces supply, which in turn increases prices. This can lead to a decrease in consumer surplus, as consumers pay more for the same goods or have fewer options. They also may reduce the efficiency in the market.

The foreign exporters, if they receive the quota rights, get the rents. In other words, the quota could ensure that foreigners get the surplus that consumers would have received in a free market. In the end, government auctions rights to import within the quota can generate government revenue.

Understanding quota rents is crucial for grasping the complexities of trade policy. By examining who benefits from these rents, economists and policymakers can better assess the impact of trade restrictions and formulate policies that promote economic efficiency and fairness. It highlights the interplay between government intervention, market dynamics, and the distribution of wealth in the global economy. It is a key element in understanding the intricate effects of trade restrictions.

The economic analysis does not end with the basic calculations; rather, they extend to the broader effects. Quota rents can influence international trade relations, which depend on how the government administers the quota. If the government auctions the quota rights for their full price, then the government receives the quota rents. This is effectively a tariff in its impact. The rents are equivalent to a specific tariff set equal to the difference in prices. If there are no transportation costs, a quota holder can make a pure profit, equal to the difference in prices.

The allocation of quota rents can also have implications for competition within a domestic market. If the quota rights are given to only a few firms, this may concentrate market power and potentially hinder competition. Conversely, if quota rights are distributed widely or auctioned, this may foster more competition. It highlights the fact that policies such as import restrictions and tariffs affect what a customer pays for a product.

In summary, quota rents are a critical, yet often overlooked, aspect of international trade. They highlight the complex ways in which trade restrictions impact economies. The core question, and the one that needs to be continually assessed, is how quota rents are allocated. This decision shapes the winners and losers of trade policy and determines the ultimate economic impact of quotas.